To have a clear view of what to expect from the markets this new week being the first week of March, we need to clearly understand the economic events to be released.

Let's analyze the following events from the Economic Calendar to help traders make informed decisions.

Trading Recommendations and signals to be included in the analysis for AUDUSD, USGJPY, GBPJPY, EURUSD, EURJPY, GBPUSD, Gold and EUSDCHF...

All time is GMT.

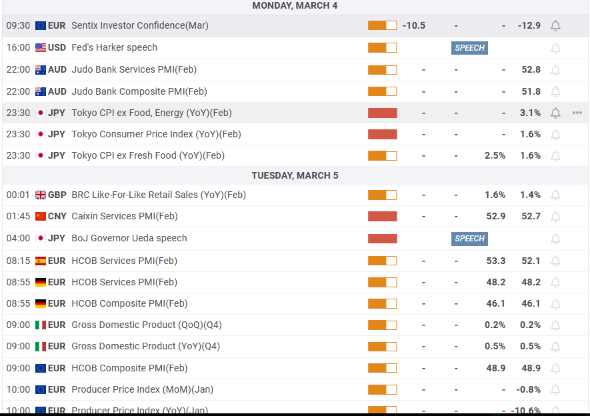

MONDAY, MARCH 4

00:00

AUD TD Securities Inflation (MoM)(Feb)

- - - Previous: 0.3%

00:00

AUD TD Securities Inflation (YoY)(Feb)

- - - Previous: 4.6%

00:30

AUD ANZ Job Advertisements(Feb)

- - - Previous: 1.7%

00:30

AUD Building Permits (MoM)(Jan)

- - Forecast: 4%. Previous: -9.5%

00:30

AUD Company Gross Operating Profits (QoQ)(Q4)

- - Forecast: 1.8%. Previous: -1.3%

00:30

AUD Building Permits (YoY)(Jan)

- - - Previous: -24%

07:30

CHF Consumer Price Index (MoM)(Feb)

- - - Previous: 0.2%

07:30

CHF Consumer Price Index (YoY)(Feb)

- - Forecast: 1.1%. Previous: 1.3%

07:45

EUR Budget Balance(Jan)

- - - Previous: €-173.26B

08:00

EUR Unemployment Change(Feb)

- - - Previous: 60.404K

09:30

EUR Sentix Investor Confidence(Mar)

- - - Previous: -12.9

16:30

USD 6-Month Bill Auction

- - - Previous: 5.13%

16:30

USD 3-Month Bill Auction

- - - Previous: 5.255%

22:00

AUD Judo Bank Services PMI(Feb)

- - - Previous: 52.8

22:00

AUD Judo Bank Composite PMI(Feb)

- - - Previous: 51.8

23:30

JPY Tokyo CPI ex Food, Energy (YoY)(Feb)

- - - Previous: 3.1%

23:30

JPY Tokyo Consumer Price Index (YoY)(Feb)

- - - Previous: 1.6%

23:30

JPY Tokyo CPI ex Fresh Food (YoY)(Feb)

- - Forecast: 2.5%. Previous: 1.6%

TUESDAY, MARCH 5

00:00

NZD ANZ Commodity Price(Feb)

- - - Previous: 2.2%

00:01

GBP BRC Like-For-Like Retail Sales (YoY)(Feb)

- - - Previous: 1.4%

00:30

JPY Jibun Bank Services PMI(Feb)

- - - Previous: 52.5

00:30

AUD Current Account Balance(Q4)

- - Forecast: 5B. Previous: 0.2B

01:45

CNY Caixin Services PMI(Feb)

- - - Previous: 52.7

03:35

JPY 10-y Bond Auction

- - - Previous: 0.741%

07:45

EUR Industrial Output (MoM)(Jan)

- - Forecast: -0.3%. Previous: 1.1%

08:15

EUR HCOB Services PMI(Feb)

- - Forecast: 53.3. Previous: 52.1

08:45

EUR HCOB Services PMI(Feb)

- - Forecast: 52.3. Previous: 51.2

08:50

EUR HCOB Composite PMI(Feb)

- - Forecast: 47.7. Previous: 47.7

08:50

EUR HCOB Services PMI(Feb)

- - Forecast: 48. Previous: 48

08:55

EUR HCOB Services PMI(Feb)

- - Forecast: 48.2. Previous: 48.2

08:55

EUR HCOB Composite PMI(Feb)

- - Forecast: 46.1. Previous: 46.1

09:00

EUR Gross Domestic Product (QoQ)(Q4)

- - Forecast: 0.2%. Previous: 0.2%

09:00

EUR Gross Domestic Product (YoY)(Q4)

- - Forecast: 0.5%. Previous: 0.5%

09:00

EUR HCOB Services PMI(Feb)

- - Forecast: 50. Previous: 50

09:00

EUR HCOB Composite PMI(Feb)

- - Forecast: 48.9. Previous: 48.9

09:30

GBP S&P Global/CIPS Services PMI(Feb)

- - Forecast: 54.3. Previous: 54.3

09:30

GBP S&P Global/CIPS Composite PMI(Feb)

- - - Previous: 53.3

09:40

EUR 6-Month Letras Auction

- - - Previous: 3.653%

09:40

EUR 12-Month Letras Auction

- - - Previous: 3.342%

10:00

EUR Producer Price Index (MoM)(Jan)

- - - Previous: -0.8%

10:00

EUR Producer Price Index (YoY)(Jan)

- - - Previous: -10.6%

10:30

EUR 5-y Note Auction

- - - Previous: 2.3%

13:55

USD Redbook Index (YoY)(Mar 1)

- - - Previous: 2.7%

N/A

NZD GDT Price Index

- - - Previous: 0.5%

14:45

USD S&P Global Services PMI(Feb)

- - - Previous: 51.3

14:45

USD S&P Global Composite PMI(Feb)

- - Forecast: 51.4. Previous: 51.4

15:00

USD ISM Services PMI(Feb)

- - Forecast: 53. Previous: 53.4

15:00

USD Factory Orders (MoM)(Jan)

- - Forecast: -2.8%. Previous: 0.2%

15:00

USD ISM Services Employment Index(Feb)

- - - Previous: 50.5

15:00

USD ISM Services Prices Paid(Feb)

- - - Previous: 64

15:00

USD RealClearMarkets/TIPP Economic Optimism (MoM)(Mar)

- - - Previous: 44

15:00

USD ISM Services New Orders Index(Feb)

- - - Previous: 55

17:00

USD Fed's Barr speech

SPEECH

20:30

USD Fed's Barr speech

SPEECH

21:30

USD API Weekly Crude Oil Stock(Mar 1)

- - - Previous: 8.428M

22:00

AUD AiG Construction PMI(Jan)

- - - Previous: -11.5

22:00

AUD AiG Industry Index(Jan)

- - - Previous: -27.3

22:00

AUD AiG Manufacturing PMI(Jan)

- - - Previous: -23.8

WEDNESDAY, MARCH 6

00:30

AUD Gross Domestic Product (QoQ)(Q4)

- - Forecast: 0.2%. Previous: 0.2%

00:30

AUD Gross Domestic Product (YoY)(Q4)

- - Forecast: 1.5%. Previous: 2.1%

07:00

EUR Exports (MoM)(Jan)

- - Forecast: 1.5%. Previous: -4.6%

07:00

EUR Imports (MoM)(Jan)

- - - Previous: -6.7%

07:00

EUR Trade Balance s.a.(Jan)

- - Forecast: €21.5B. Previous: €22.2B

09:30

GBP S&P Global/CIPS Construction PMI(Feb)

- - Forecast: 49.2. Previous: 48.8

10:00

EUR Retail Sales (YoY)(Jan)

- - - Previous: -0.8%

10:00

EUR Retail Sales (MoM)(Jan)

- - Forecast: 0.1%. Previous: -1.1%

12:00

USD MBA Mortgage Applications(Mar 1)

- - - Previous: -5.6%

12:30

GBP Budget Report

- - - -

13:15

USD ADP Employment Change(Feb)

- - Forecast: 150K. Previous: 107K

13:30

CAD Labor Productivity (QoQ)(Q4)

- - - Previous: -0.8%

14:45

CAD BoC Interest Rate Decision

- - Forecast: 5%. Previous: 5%

14:45

CAD BoC Monetary Policy Statement

REPORT

15:00

CAD Ivey Purchasing Managers Index s.a(Feb)

- - - Previous: 56.5

15:00

CAD Ivey Purchasing Managers Index(Feb)

- - - Previous: 54.4

15:00

USD JOLTS Job Openings(Jan)

- - Forecast: 8.895M. Previous: 9.026M

15:00

USD Wholesale Inventories(Jan)

- - Forecast: -0.1%. Previous: -0.1%

15:00

USD Fed's Chair Powell testifies

SPEECH

15:30

USD EIA Crude Oil Stocks Change(Mar 1)

- - - Previous: 4.199M

17:00

USD Fed's Daly speech

SPEECH

19:00

USD Fed's Beige Book

REPORT

21:45

NZD Manufacturing Sales(Q4)

- - - Previous: -2.7%

23:50

JPY Foreign Bond Investment(Mar 1)

- - - Previous: ¥-257B

23:50

JPY Foreign Investment in Japan Stocks(Mar 1)

- - - Previous: ¥-206B

THURSDAY, MARCH 7

00:30

AUD Home Loans(Jan)

- - - Previous: -5.6%

00:30

AUD Trade Balance (MoM)(Feb)

- - Forecast: 11,500M. Previous: 10,959M

00:30

AUD Investment Lending for Homes(Jan)

- - - Previous: -1.3%

00:30

AUD Imports (MoM)(Feb)

- - - Previous: 4.8%

00:30

AUD Exports (MoM)(Feb)

- - - Previous: 1.8%

03:00

CNY Trade Balance CNY(Feb)

- - - Previous: 540.9B

03:00

CNY Trade Balance USD(Feb)

- - Forecast: $107B. Previous: $75.34B

03:00

CNY Imports (YoY)(Feb)

- - Forecast: 2%. Previous: 0.2%

03:00

CNY Exports (YoY) CNY(Feb)

- - - Previous: 3.8%

03:00

CNY Exports (YoY)(Feb)

- - Forecast: 2.5%. Previous: 2.3%

03:00

CNY Imports (YoY) CNY(Feb)

- - - Previous: 1.6%

06:45

CHF Unemployment Rate s.a (MoM)(Feb)

- - - Previous: 2.2%

07:00

EUR Factory Orders s.a. (MoM)(Jan)

- - Forecast: -6%. Previous: 8.9%

07:00

EUR Factory Orders n.s.a. (YoY)(Jan)

- - - Previous: 2.7%

07:00

GBP Halifax House Prices (YoY/3m)(Feb)

- - - Previous: 2.5%

07:00

GBP Halifax House Prices (MoM)(Feb)

- - - Previous: 1.3%

08:00

CHF Foreign Currency Reserves(Feb)

- - - Previous: 662B

08:00

CNY Foreign Exchange Reserves (MoM)(Feb)

- - - Previous: $3.219T

09:40

EUR 10-y Obligaciones Auction

- - - Previous: 3.139%

09:40

EUR 3-y Bond Auction

- - - Previous: 2.875%

09:40

EUR 5-y Bond Auction

- - - Previous: 2.873%

12:30

USD Challenger Job Cuts(Feb)

- - - Previous: 82.307K

13:15

EUR ECB Monetary Policy Statement

REPORT

13:15

EUR ECB Main Refinancing Operations Rate

- - Forecast: 4.5%. Previous: 4.5%

13:15

EUR ECB Rate On Deposit Facility

- - Forecast: 4%. Previous: 4%

13:30

CAD Exports(Jan)

- - - Previous: $64.07B

13:30

CAD Imports(Jan)

- - - Previous: $64.39B

13:30

CAD Building Permits (MoM)(Jan)

- - - Previous: -14%

13:30

CAD International Merchandise Trade(Jan)

- - - Previous: $-0.31B

13:30

USD Initial Jobless Claims 4-week average(Mar 1)

- - - Previous: 212.5K

13:30

USD Initial Jobless Claims(Mar 1)

- - - Previous: 215K

13:30

USD Continuing Jobless Claims(Feb 23)

- - - Previous: 1.905M

13:30

USD Nonfarm Productivity(Q4)

- - Forecast: 3.2%. Previous: 3.2%

13:30

USD Goods and Services Trade Balance(Jan)

- - Forecast: $-63.4B. Previous: $-62.2B

13:30

USD Goods Trade Balance(Jan)

- - - Previous: $-90.2B

13:30

USD Unit Labor Costs(Q4)

- - Forecast: 0.5%. Previous: 0.5%

13:45

EUR ECB Press Conference

SPEECH

15:00

USD Fed's Chair Powell testifies

SPEECH

15:30

USD EIA Natural Gas Storage Change(Mar 1)

- - - Previous: -96B

16:30

USD 4-Week Bill Auction

- - - Previous: 5.285%

16:30

USD Fed's Mester speech

SPEECH

20:00

USD Consumer Credit Change(Jan)

- - Forecast: $10B. Previous: $1.56B

23:30

JPY Labor Cash Earnings (YoY)(Jan)

- - - Previous: 1%

23:30

JPY Overall Household Spending (YoY)(Jan)

- - Forecast: -4.3%. Previous: -2.5%

23:50

JPY JP Foreign Reserves(Feb)

- - - Previous: $1,291.8B

23:50

JPY Trade Balance - BOP Basis(Jan)

- - - Previous: ¥115.5B

23:50

JPY Bank Lending (YoY)(Feb)

- - - Previous: 3.1%

23:50

JPY Gross Domestic Product Annualized(Q4)

- - - Previous: -0.4%

23:50

JPY Current Account n.s.a.(Jan)

- - Forecast: ¥-330.4B. Previous: ¥744.3B

FRIDAY, MARCH 8

05:00

JPY Eco Watchers Survey: Current(Feb)

- - - Previous: 50.2

05:00

JPY Eco Watchers Survey: Outlook(Feb)

- - - Previous: 52.5

05:00

JPY Leading Economic Index(Jan) PREL

- - - Previous: 110.2

05:00

JPY Coincident Index(Jan) PREL

- - - Previous: 115.9

07:00

EUR Industrial Production n.s.a. w.d.a. (YoY)(Jan)

- - - Previous: -3%

07:00

EUR Producer Price Index (MoM)(Jan)

- - Forecast: -0.1%. Previous: -1.2%

07:00

EUR Producer Price Index (YoY)(Jan)

- - - Previous: -8.6%

07:00

EUR Industrial Production s.a. (MoM)(Jan)

- - Forecast: 0.7%. Previous: -1.6%

07:45

EUR Imports, EUR(Jan)

- - - Previous: €57.021B

07:45

EUR Trade Balance EUR(Jan)

- - - Previous: €-6.829B

07:45

EUR Current Account(Jan)

- - - Previous: €-0.7B

07:45

EUR Exports, EUR(Jan)

- - - Previous: €50.192B

08:00

EUR Industrial Output Cal Adjusted (YoY)(Jan)

- - - Previous: -0.2%

09:00

EUR Producer Price Index (MoM)(Jan)

- - - Previous: -0.9%

09:00

EUR Producer Price Index (YoY)(Jan)

- - - Previous: -16%

10:00

EUR Gross Domestic Product s.a. (QoQ)(Q4)

- - Forecast: 0%. Previous: 0%

10:00

EUR Gross Domestic Product s.a. (YoY)(Q4)

- - Forecast: 0.1%. Previous: 0.1%

10:00

EUR Employment Change (QoQ)(Q4)

- - - Previous: 0.3%

10:00

EUR Employment Change (YoY)(Q4)

- - - Previous: 1.3%

N/A

GBP NIESR GDP Estimate (3M)(Feb)

- - - Previous: -0.1%

13:30

CAD Unemployment Rate(Feb)

- - Forecast: 5.8%. Previous: 5.7%

13:30

CAD Net Change in Employment(Feb)

- - Forecast: 20K. Previous: 37.3K

13:30

CAD Capacity Utilization(Q4)

- - - Previous: 79.7%

13:30

CAD Average Hourly Wages (YoY)(Feb)

- - - Previous: 5.3%

13:30

CAD Participation Rate(Feb)

- - - Previous: 65.3%

13:30

USD Average Hourly Earnings (YoY)(Feb)

- - Forecast: 4.4%. Previous: 4.5%

13:30

USD U6 Underemployment Rate(Feb)

- - - Previous: 7.2%

13:30

USD Labor Force Participation Rate(Feb)

- - - Previous: 62.5%

13:30

USD Unemployment Rate(Feb)

- - Forecast: 3.7%. Previous: 3.7%

13:30

USD Average Hourly Earnings (MoM)(Feb)

- - Forecast: 0.3%. Previous: 0.6%

13:30

USD Nonfarm Payrolls(Feb)

- - Forecast: 200K. Previous: 353K

13:30

USD Average Weekly Hours(Feb)

- - Forecast: 34.3. Previous: 34.1

17:00

USD USDA WASDE Report

REPORT

18:00

USD Baker Hughes US Oil Rig Count

- - - Previous: 506

20:30

JPY CFTC JPY NC Net Positions

- - - Previous: ¥-132.7K

20:30

EUR CFTC EUR NC Net Positions

- - - Previous: €62.9K

20:30

AUD CFTC AUD NC Net Positions

- - - Previous: $-79.2K

20:30

USD CFTC Gold NC Net Positions

- - - Previous: $141.6K

20:30

USD CFTC Oil NC Net Positions

- - - Previous: 224.8K

20:30

USD CFTC S&P 500 NC Net Positions

- - - Previous: $-224.2K

20:30

GBP CFTC GBP NC Net Positions

- - - Previous: £46.4K

Economic Calendar, courtesy: Fxstreet.com

The Analysis

Analyzing the economic events for the upcoming week, particularly focusing on the trading recommendations and signals for the specified currency pairs and assets:

AUDUSD:

Monday's TD Securities Inflation data for February will be crucial for assessing inflationary pressures in Australia, impacting the AUD.

Also, keep an eye on the ANZ Job Advertisements and Building Permits data, as they provide insights into the labor market and construction sector, affecting the AUDUSD pair.

USDJPY:

Pay attention to the Tokyo CPI data on Monday, especially the Tokyo CPI excluding fresh food, which could influence the JPY and subsequently the USDJPY pair.

GBPJPY:

Tuesday's S&P Global/CIPS Services PMI and Composite PMI data for February will be significant for gauging the performance of the UK services sector, which could impact the GBPJPY pair.

EURUSD:

Watch for the Eurozone's Gross Domestic Product data on Tuesday, as well as the ECB Monetary Policy Statement and Press Conference on Thursday, which can influence the EURUSD pair.

EURJPY:

The same events affecting the EURUSD pair will likely impact the EURJPY pair, with additional attention to the JPY-specific data mentioned earlier.

GBPUSD:

Similar to GBPJPY, the S&P Global/CIPS Services PMI and Composite PMI data on Tuesday will be key drivers for the GBPUSD pair.

Gold:

Economic data releases, especially those related to inflation and market sentiment, can impact the price of gold. Traders should monitor events like the USD Average Hourly Earnings, Nonfarm Payrolls, and Consumer Credit Change on Friday.

USDCHF:

The same events influencing the USD will also impact the USDCHF pair, with additional attention to Swiss economic data such as the Consumer Price Index and Foreign Currency Reserves.

Overall, traders should closely follow the economic indicators mentioned above, as well as any unexpected geopolitical developments or central bank announcements, to make informed trading decisions across the specified currency pairs and assets.

From all of us at Pipsoclock, we wish you a profitable week ahead!

Ifeanyi Uche